The government often attempts to pass legislation that

solves a particular problem in our society.

When the government passes a law or takes an action, we refer to this as

a policy – a consistent way of doing things.

Public policy is typically divided into three main

categories – domestic, economic, and foreign.

Before examining each of these policy areas more in depth, it’s

important to first look at the policy making process. How does this government come to the point

where they create a new policy or alter an already existing one?

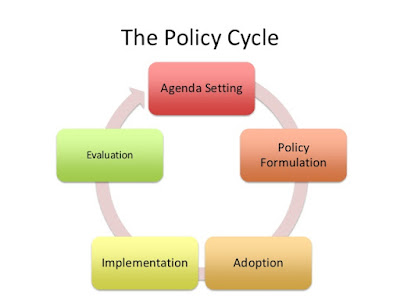

The policy making

process has five key steps:

1. Agenda Building

2. Policy Formulation

3. Policy Adoption

4. Policy Implementation

5. Policy Evaluation

First, the agenda building piece of this

process refers to the priority list of the government. Both Congress and the President have an

agenda about what they want to achieve during their time in office. However, government entities are not the only

parties who can help determine the agenda for policy changes.

Interest groups, political parties, the public, and private

businesses all attempt to sway the government to make policy changes. The agenda is often driven by a need (real or

perceived) in society, not necessarily because someone wants something changed. For instance, after Hurricane Katrina hit in

2005, the government saw a need for changing the way federal agencies respond

in an emergency situation. Another

example of the need for a change would be the federal government’s adoption of

“net neutrality” rules that govern the Internet.

Can you answer: What would be on your agenda if you were the

president or a member of Congress?

After the government becomes aware of what issues are part

of the agenda, the next step of the policy process is policy formulation,

whereby government officials create potential changes to laws. This work includes writing specific

legislation that will be scrutinized by members of Congress, the president, the

general public, the media, and various groups.

Once a specific policy has been created, the process moves

to policy

adoption, where Congress and the president must pass any proposed bills

into law if they wish to move the policy forward. Because the lawmaking process is difficult to

navigate, the supporters of a given policy sometimes must compromise certain

parts of a bill so critics will agree to pass it.

After the law has been passed through Congress and has the

president’s signature, then comes policy implementation. When a law is passed, it often requires

action by the government to make the policy happen.

When the Affordable Care Act was passed, the law stipulated

the government had the duty to create a website where citizens purchasing

health insurance could shop for different policies to meet their needs. The Department of Health and Human Services

was tasked with the job of creating this website. This is an example of how a policy is

implemented.

The final phase of the policy process is policy

evaluation. Groups inside and

outside of the government look at the successes or failures of a particular

policy. With respect to the Affordable

Care Act, the implementation of the website was a colossal failure when

implemented, but not because it was a bad idea.

The site crashed and had extremely long wait times that frustrated users

and ultimately led to the resignation of then Secretary of Health and Human

Resources Kathleen Sebilius.

Another significant example of policy evaluation is how

critics viewed the No Child Left Behind Act of 2001. This law reformed educational policies, but

has been widely criticized by teachers, government officials, and other outside

groups. Since then, it has been amended

and still continues to be evaluated for potential changes.

Can you answer: what government policies are currently being

heavily scrutinized by the public and members of Congress?

Domestic Policy

The policy making process is used for all three types of

policies, but domestic policy

specifically aims to solve problems occurring within the nation’s borders. Internal problems make up much of what the

country struggles to correct and there are a wide variety of perspectives

Health care has consistently been a domestic policy issue

for the last century. Costs of care,

medicine, and other associated services have radically increased and this

presents a problem since we all get sick at some point. The population is living longer, new

technologies are more expensive, and many people do not have the money (or a

health insurance plan) to cover their medical costs.

Because most Americans are of the belief that no one should

be denied health care services because they lack financial resources, the

government believed policies need to be enacted to ensure all Americans receive

adequate care. Two major programs the

federal government enacted to alleviate this problem are Medicare and Medicaid.

Medicare is a government program that provides health

insurance costs for elderly citizens, regardless of their level of income. The eligibility for this program is granted

once a person turns 65 years of age. The

program is funded through a tax on income.

Medicaid is a separate government program that provides health

insurance to financially poor citizens.

The government sets a poverty level that determines eligibility for this

program, and it is funded mostly by a grant from the federal government and

supplemented by individual states.

One of the more significant problems with the Medicare and

Medicaid programs is the rising cost to fund them. When people retire, they are no longer

putting tax dollars into the system.

They are living longer and thus, taking money out of the system for

longer periods of time. Additionally,

the ‘baby boomer’ generation is larger than other generations. There are not enough younger workers to

support these programs.

Since Medicaid eligibility is determined by income, the

number of citizens receiving these benefits fluctuates, but the trend has seen

this number also increasing.

The overall costs of Medicare and Medicaid are approaching

$1 trillion for this year and have a projected increase each year for the next

ten years. The percentage of the federal

budget of these programs also increases each year.

|

| Small illustration of current fiscal policy |

Another key domestic policy that has created political

turmoil in recent years is environmental policy regulation. The government has enacted several pieces of

legislation that empower the Environmental Protection Agency to regulate the

amount of pollutants in our ground, air, and water.

Government regulation of pollutants is not the only

environmental issue in play.

Presidential administrations have begun to address the issue of global

warming and created restrictions and penalties for the burning of fossil fuels

that emit carbon dioxide and other greenhouse gases.

Democrats and Republicans have vehemently disagreed about

the scientific evidence behind global warming studies, but the Obama

administration has adjusted policies under existing laws to discourage use of

coal and oil in favor of cleaner forms of energy.

Economic Policy

The federal government has a vested interest in maintaining

a vibrant economy. The prosperity of

individuals and businesses means not only a happy population, but increased

revenue through taxes. This, in turn,

allows the government to provide more services (i.e. social programs and

defense) for the people.

Though economic policy is technically part of domestic

policy, it is deemed important enough to be considered by itself. We typically distinguish it from domestic

policy (as domestic policy deals with social issues).

Government action affecting the economic is divided into two

distinct policy areas: fiscal policy and monetary policy.

Fiscal policy

relates to the federal government’s taxing and spending policies that affect

businesses and citizens. The tax

policies of our federal government generate the money needed to run the day to

day operations of the government and fund the social programs we have in place.

The budget for the federal government in 2016-2017 is

approximately $4 trillion, and the primary source of this money comes from the

income tax. This will make up about $1.5

trillion of the money needed for government operations.

Currently, the United States uses a progressive tax on income.

This means that the higher one’s income, the higher percentage of that income

will be paid to the federal government in taxes. The lowest earning incomes are taxed at a

rate of 10% while the highest bracket is at 35%.

While a progressive tax is the current policy, many

conservatives have argued for a regressive

tax. In this situation, the tax

rates would decrease as income increases.

On its face, this seems unfair, but the concept behind it is that the

highest income earners would be free to invest and spend more of their money

(since they’re taxed at a low rate).

When these wealthy individuals invest and spend, it stimulates the

economy and benefits every worker.

While a regressive tax is unlikely to become policy, another

segment of society has pushed for a flat

tax on income. This would tax all

incomes at the same percentage.

Can you answer: What would be the benefits and drawbacks to

each type of tax listed above?

Taxes on corporations, luxury taxes, and numerous other

forms of taxes make up the rest of what the federal government collects. However, the biggest problem the United

States has with its fiscal policy is deficit

spending. This occurs when the

government spends more money than it collects in taxes.

The most common form of dealing with deficit spending is by

borrowing money from other nations. China

and Japan are the two leading lenders to the United States. For many years, the federal government has

habitually borrowed money from other nations to make up the shortfall in its

budget.

Here’s the way it will look for 2016-2017:

Outlays (expenditures):

$3.952 trillion

Receipts (tax money):

$3.336 trillion

Deficit for 2016-2017:

$616 billion

The federal government will borrow that money to meet its

obligations. When they borrow that

money, the debt incurred is added to an already running tab from previous

years. Currently, the overall national debt is approximately $19

trillion.

The three major entitlement programs (Social Security,

Medicare, and Medicaid) account for 50% of the federal budget. Defense spending takes an additional 25% of

the budget. This does not leave much

room for other programs and expenditures.

The three major entitlement programs (Social Security,

Medicare, and Medicaid) account for 50% of the federal budget. Defense spending takes an additional 25% of

the budget. This does not leave much

room for other programs and expenditures.

Because entitlement programs and defense are considered so

important to the nation, members of the government often lack the political

courage to even suggest making changes. As

a result, the federal government continues to borrow.

The government has operated at a budget deficit for most of

its existence, and typically, it’s not that significant of a problem. However, the exponential growth of the

national debt during the last 15 years is a concern.

Aside from fiscal policy, the federal government also

controls monetary policy,

which is where the federal government controls the supply of money in an

attempt to keep a stable economy. In the

United States, monetary policy is controlled by the Federal Reserve Bank System,

which is often referred to as “The Fed.”

The Fed is a series of national banks controlled by a board

of five individuals who make some of the most important economic decisions for

the United States. They have several

tools to control the overall flow of money and the economy.

| ||

| The Fed controls the amount of money flowing |

First, the Fed controls

the amount of money that circulates at any given moment. They can choose to release more money into

the system, thereby encouraging more economic activity among businesses, banks,

and individuals. When money is easier to

access, the goal is to speed up the economy.

When the Fed contracts the amount of money available, the goal is to

slow down the economy and prevent a high degree of inflation.

The Fed also requires larger banks to give the Fed a sizable

deposit of their cash, so that in case of an emergency, the Fed can infuse any

needed cash to that particular bank. By

raising or lowering the dollar amount on that deposit, the Fed can speed up or

slow down the economy.

Another way the Fed can speed up or slow down economic

activity in the nation is by increasing or decreasing interest rates at which

they loan money to banks. Those banks,

in turn, raise or lower the interest rates they provide to their

customers.

A good example of the Fed in action was in 2007-2008, when

the economic recession from the housing crisis hit the country. To encourage people to buy houses and cars,

the Fed lowered interest rates to 0.0%, which meant citizens could purchase a

home at extraordinarily low rates.

Can you answer: Why might the federal government want to slow the growth and expansion of the economy?

Economic policy also includes government decisions that will

determine how the United States economically interacts with the rest of the

world. This includes determining what

the nation’s policy will be with respect towards tariffs. These are

taxes specifically on goods imported from other nations. The government can also implement an import quota, a limited number

of any good. These measures are designed

to make foreign products more expensive, encouraging Americans to buy

American-made products.

The government has also entered into treaties with foreign

nations regarding free trade, such as the North

American Free Trade Agreement (NAFTA).

This treaty, which includes the United States, Canada, and Mexico,

eliminated the trade barriers that existed between these nations, including

tariffs. The agreement allowed the three

geographic neighbors to freely trade goods and services competitively, with

little restrictions.

The overall value of NAFTA is still debated today, because

while the elimination of trade barriers opened up economic opportunities in

neighboring countries, the United States manufacturing sector lost a

significant amount of jobs to Mexico, where laborers work for significantly

less wages.

Foreign Policy

A nation’s foreign

policy is characterized by its external goals and the tactics they use

to achieve these goals. It should be

noted that because foreign policy is directed primarily by the president,

foreign policy goals tend to be more fluid than domestic policy. Presidents have an easier time implementing

their agenda in foreign policy, because it does not frequently coincide with

Congress’ power or authority.

The United States has multiple tools at its discretion for

achieving its objectives. One of the

most widely used means of achieving goals is through diplomacy. Most

nations can work out their problems through effective communication and

peaceful means.

Diplomacy often includes the development of a treaty or

executive agreement with a foreign nation.

Treaties are binding

agreements between nations that must be carried out by every presidential administration,

regardless of whether or not they agree with the treaty. Treaties are negotiated by the president and

ratified by 2/3 of the Senate.

Executive agreements

differ because they are negotiated by the president and require no Senate

action. The drawback is that executive

agreements are not binding. Future

presidents are not obligated to continue with those policies.

Another tactic employed often by the United States is

through providing economic aid

to foreign nations. Since the United

States has a significant amount of financial resources, it uses money as a

means of garnering goodwill and favors from other nations. Typically, though, the money the United

States provides these nations must be used on items such as food, medicine, or infrastructure,

and not for weapons. Currently, the

federal government allots about $35 billion to be distributed annually.

A more specific example of economic aid would be the

implementation of the Marshall Plan in post-World War II Europe. The United States offered billions of dollars

in grants and loans to European nations to help them rebuild. While Americans were sympathetic to Europeans

who had lost so much during the war, the United States was not acting purely

out of kindness.

The Marshall Plan required that recipient nations of the money

spend that money on American products and services. The economic aid to Western Europe also

prevented the spread of communism, which was the primary foreign policy goal of

the United States from 1945 to 1989.

With economic aid, the United States provides vital cash to

nations who would otherwise struggle to serve their people. If a nation provokes the United States or

misuses their economic aid, they risk economic

sanctions. The federal

government understands that the United States is one of the largest markets in

the world, and withholding trade and economic aid packages to foreign nations

can prove catastrophic.

For instance, North Korea spent considerable time and

resources to build a nuclear weapons program.

American presidents have consistently withheld economic aid and

prevented trade with North Korea as a form of punishment. These sanctions have crippled North Korea’s

ability to sustain its population and provide key resources to them.

Additionally, President Obama and Secretary of State John

Kerry negotiated an agreement with Iran, whereby they would give up the pursuit

of a nuclear weapons program in exchange for an economic aid package and the

removal of trade sanctions.

The federal government has also demonstrated a willingness

to provide technical assistance to foreign nations. Many Third World nations lack the scientific

know-how or expertise to bring about significant change in their

countries. The United States will

essentially offer technical information, policy ideas, or help in the form of

individuals with certain skills in exchange for something in return.

Presidents and other federal officials have one more

significant way to influence other nations – military intervention.

When the United States cannot convince or manipulate another nation to

do what we want, the last resort is to use force. The size and might of the United States

military gives the federal government many different options in terms of

coercing other nations into action.

In most instances, military intervention is a last

resort. However, one notable example of

using the military to achieve an objective came in 2011, when President Obama

ordered a covert military action on foreign soil (Pakistan) to capture or kill

Osama bin Laden. The president bypassed

any discussion with Pakistani government officials and simply acted in a way

that he believed would most like achieve a goal.

President Obama also routinely authorizes drone strikes on

targets in the Middle East in an effort to curtail terrorism. This is a continued policy from the George W.

Bush administration.

The Bush administration also authorized a military invasion

into Iraq in 2003. The Iraqi dictator at

the time, Saddam Hussein, had violated international agreements and the Bush

administration claimed Hussein was developing weapons of mass destruction. President Bush opted not continue with any

diplomatic efforts or economic sanctions because he believed that time was a

crucial factor.

No comments:

Post a Comment